The recently published ECM Benchmarking Report 2020-2021 demonstrates the immense impact of the pandemic on European city tourism. The 17th edition of the European Cities Marketing (ECM) Report includes 107 European cities and features results from 2020.

Until then, cities were the clear leaders of the European tourism industry, according to the study, and altogether ECM member destinations represented 690 million tourist bednights in 2019 (ECM Benchmarking Report, 2020). For years, city tourism has been the most dominant and dynamic aspect of European tourism, according to ECM.

As expected, 2020 was a turbulent year for the tourism industry due to Covid-19. ECM Report determined that the cities included in the report achieved an average decline of 60.9%, which is far from the previous year’s growth rate of 4.3%.

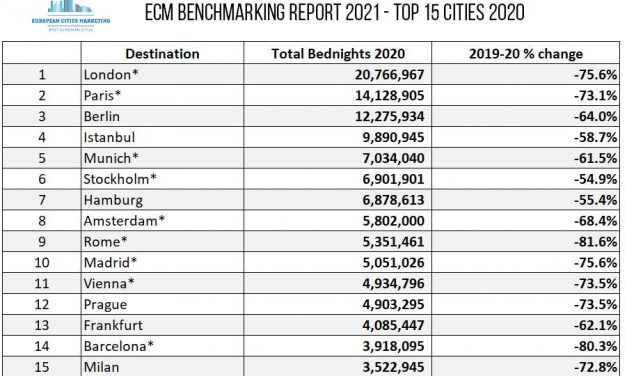

In spite of a challenging year, the top three cities in terms of total bednights in 2020 remained the same as previous year: London, Paris, and Berlin. Among the top 15, Stockholm and Hamburg had the lowest decreases in 2020, which led to a major improvement in their rankings from 2019: Stockholm moved from being ranked 13th to 6th and Hamburg from 12th to 7th.

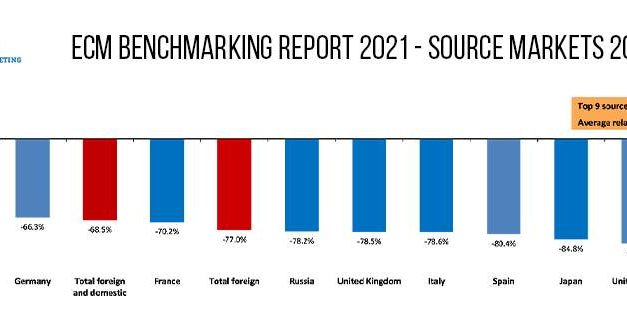

By looking at Europe’s main source markets, it is evident that all of them recorded major decreases. The most affected were the long-haul markets which was to be expected due to travel restrictions in the times of pandemic: China (-88.9%), the United States (-88.2%), and Japan (-84.8%).

The past year has also shown a negative average annual growth rate in international bednights in both the ECM Report cities (-77.0%) and the EU 28 nations (-57.8%). Cities decreased much more than other regions (-68.5% versus -32.6%) in terms of total bednight volumes.

Further analysis revealed that the average growth rate of bed capacity for ECM Report cities was -5.0% in 2020. Regarding the bed occupancy, the benchmark average was only 21.3%. Unlike previous years, winter (i.e., pre-pandemic period) was the busiest season with an average of 1.67 bednights per citizen.

Despite this challenging scenario, DMOs (Destination Marketing Organisations) are almost in total agreement that the crisis will lead the land of travel and tourism towards a more sustainable future (89% agrees partly or completely, ECM DMO Funding Survey 2020). Also, most of the DMOs feel that the crisis has strengthened their political capital.

The report costs 690€ with the full dataset of figures, and is free for members of European Cities Marketing. It can be ordered from www.europeancitiesmarketing.com/ecm-benchmarking-report.

- The Top cities 2020; credit: ECM Report

- Development of the source markets; credit: ECM Report